The Small Business Administration (SBA) 504 Program has become a powerful tool for businesses that want attractive financing for building purchases, new construction, refinancing, and equipment.

Because of the uncertainty the pandemic caused, an increased number of businesses sought out the SBA 504 program to enjoy the long-term fixed interest rates. As a result, Business Lending Partners (BLP), the financial specialty area at the Racine County Economic Development Corporation (RCEDC), saw an influx of SBA 504 loans approved in 2020.

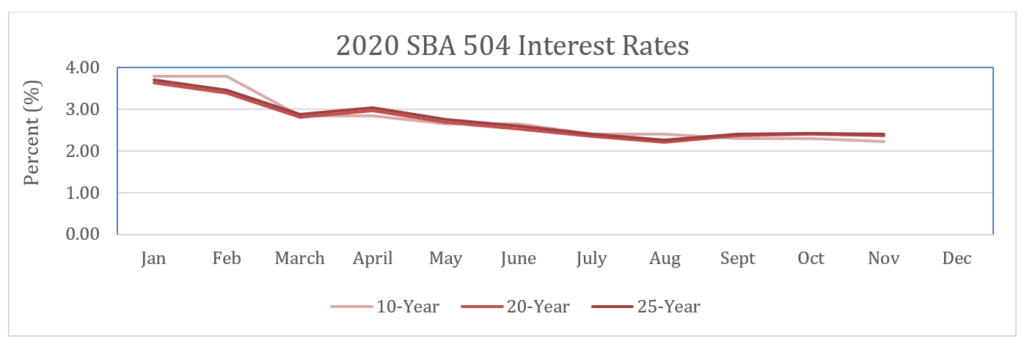

Month-after-month, the interest rates on these long-term loans declined, making this program even more attractive to growing businesses as well as those looking to refinance.

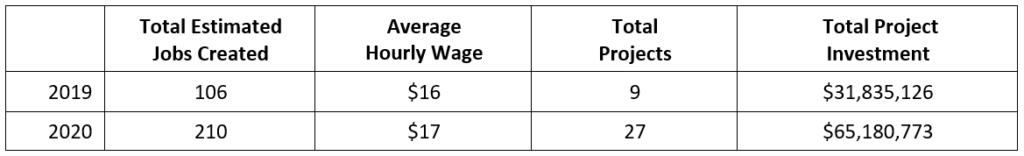

According to a BLP report, the financial team saw an increase of 200% in total projects and a 110% increase in total project investment. The majority of projects that BLP assisted with in 2020 were real estate, restaurants and manufacturing.

As part of RCEDC’s mission, these projects must provide an aspect of community development. According to the BLP report, approximately 210 jobs are to be created from the SBA 504 dollars facilitated in 2020.

Carolyn Engel, Business Finance Manager at RCEDC, said that 2020 was a year that the BLP team buckled down and capitalized as much as possible on the historic low rates of these loans. She noted a special appreciation for the opportunity to support more than $5 million in loans toward disadvantaged businesses (women-, minority- or veteran-owned businesses).

“I am incredibly proud of our team for meeting the needs of our borrowers as well as the partnerships we’ve fostered with banks throughout Wisconsin,” said Engel. “Almost 80 percent of the projects approved in 2020 came from bank referrals. That is why it is so important that the Wisconsin commercial lending community understands the benefits of this program.”