Village of Sturtevant

Located less than 2 miles from Interstate‐94, Sturtevant is home to almost 7,000 residents and nearly 250 businesses. Centrally located between Milwaukee and Chicago, Sturtevant offers an innovative and supportive environment for large and small businesses. Sturtevant is home to a mix of internationally owned firms and distribution companies with many located within the community’s two business parks.

Recent Sturtevant News

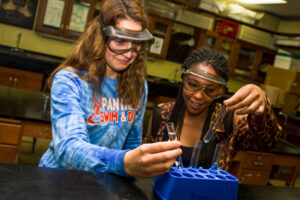

At the October 14, 2025, RCEDC Leadership Council meeting, local educators in a panel discussion highlighted how Racine County high schools are equipping students for future careers and fostering connections with area employers.

The Village of Sturtevant (The Village), in collaboration with Racine County Economic Development Corporation (RCEDC) is pleased to announce support for Grand Appliance’s upcoming facility expansion in Sturtevant. Since relocating to Sturtevant in 2017, Grand Appliance has invested in approximately 11.23 acres, generating an assessed value of $8,040,400. The company’s new expansion project includes a 48,000-square-foot addition to its current facility, part of a larger 137,000-square-foot building. With a total investment of $4.5 million, the expansion is projected to create 15 new jobs over the next three years, offering an average salary of $55,000.

Sound Decisions, a longtime automotive and electronics business in Racine County, is expanding its operations with the purchase of four adjacent commercial condominiums in Yorkville. Owner Chris Hilbert—who took over the business from his parents in 2013—will consolidate two companies, Sound Decisions and Echo Sales/MED, under one roof. With financing support from RCEDC and Josh Sopczak at Town Bank, Chris secured a Revolving Loan Fund (RLF) with just 10% down, helping move this expansion forward. Today, the business operates as both a retailer and a regional distributor for top brands like Alpine, Viper, and Metra.

This year-long program has been successful for many years in Milwaukee and now BizStarts will be available in the City of Racine. Join us on September 4, 2025 at Gateway Technical College's SC Johnson iMET Center in Sturtevant.

This year-long program has been successful for many years in Milwaukee and now BizStarts will be available in the City of Racine. Join us on September 5th at Racine’s Gateway Technical College!

Lisa Rivers embarked on her entrepreneurial journey in 2022 to share her passion for preparing homemade food with others. Inspired by her childhood love of baking with an Easy Bake Oven, Lisa perfected her skills over the years by baking and cooking for family, friends, and co-workers. As her customer base grew, Lisa decided it was time to secure a fixed location for her business.

The Racine County Economic Development Corporation (RCEDC) and its partner communities are proud to present a comprehensive overview of loans and grants specifically designed to support local small businesses.

In a 4-part video series RCEDC Staff, Andrea Safedis and Wesley Walsh, explain what who and how community loans, also known as Revolving Loan Funds (RLFs), work.

In a 2-minute video RCEDC Staff, Andrea Safedis and Wesley Walsh, explain what who and how the Matching Grant Programs (MGP) work.

Racine County serves as a central hub for a diverse range of enterprises, including global corporations, family-owned businesses, forward-thinking industry pioneers, and burgeoning startups. With a thriving business community, Racine County provides a conducive environment for manufacturers, logistics companies, and various other ventures.

Sturtevant, WI – Bolstered by the acquisition of three loans from RCEDC and the receipt of a Sturtevant grant, M&J Krueger Trucking has been able to sustain growth and development at its current location.

In January 2022, BRP launched production of the Sea-Doo Switch, a customizable pontoon at its Sturtevant, WI manufacturing facility. To support production and distribution requirements, BRP plans to invest more than $14 million in improvements to its existing manufacturing facility and the development of an off-site shipping yard that will hold the finished product prior to distribution.

INVEST IN RCEDC

RCEDC’s mission is to grow Racine County’s property tax base by supporting business expansions and providing employment opportunities to Racine County residents. In 2024, RCEDC staff were able to facilitate 71 projects that included comprehensive site selection, loans, grants, and incentives resulting in $749 million in expansion projects and/or new developments. RCEDC’s Loan Committee and Board of Directors approved $9.7 million in loans and $136,120 in grants to facilitate this private investment.